Asia Week Ahead: Rate Decisions In Japan, China And Taiwan Take Centre Stage

Image Source: Pixabay

The Bank of Japan is expected to leave rates unchanged next week. Markets also will focus on the Shunto wage negotiation results, which may impact the timing of the BoJ's next move. On Thursday, central banks in China and Taiwan are likely to hold benchmark rates steady, too.

Japan: Bank of Japan likely to keep policy rate unchanged

No policy action is expected when the Bank of Japan meets Wednesday. We believe Governor Ueda will provide directional guidance, but not on the timing or magnitude of rate hikes to come.

With inflation set to overshoot the BoJ's forecast and the possibility of another strong gain from the Shunto wage negotiations, the BoJ is likely to resume rate hikes in May. Meanwhile, the February consumer price index will be released on Friday. Headline inflation is likely to ease to 3.5% year on year from 4% in January after a resumption of the government's energy subsidy programme and fresh food prices stabilised.

Despite the ongoing tariff uncertainty, Japanese exports are expected to grow rapidly in February, partly due to last year's low base and the front-running of shipments of major items such as cars and IT goods.

China: first data dump of 2025 and policy rate call

China’s first data dump of 2025 hits Monday, when we’ll get our first look at hard activity figures for the first two months of the year.

We expect retail sales to edge higher, but remain relatively soft at around 4.0% YoY. The expansion of trade-in programmes this year should support growth in the coming months. Industrial production, meanwhile, may soften to 5.2% YoY amid weaker external demand. Growth in fixed-asset investment (FAI) is expected to remain tepid as the private sector continues to drag on growth. We're looking for FAI growth of around 3.6% YoY, year to date.

We'll be closely tracking February property market data to see if the last month saw a swing to positive sequential growth. Data in January showed new home prices dropped just 0.07% month on month, while more cities saw prices increase.

Finally, China’s loan prime rates will be released Thursday. Barring a cut to the benchmark 7-day reverse repo rate in the coming days, it’s safe to assume no change in the loan prime rate (LPR) next week.

Taiwan: monetary policy meeting in focus

The quarterly monetary policy meeting of Taiwan’s central bank on Thursday is next week’s main event. We expect officials to keep rates unchanged at 2.0%. At the previous meeting, guidance largely tilted toward the hawkish side. It will be worth seeing if there’s any change after several months of softer inflation.

Also Thursday, February export orders data will be released. We’re looking for orders to bounce back to positive growth of 9.4% YoY.

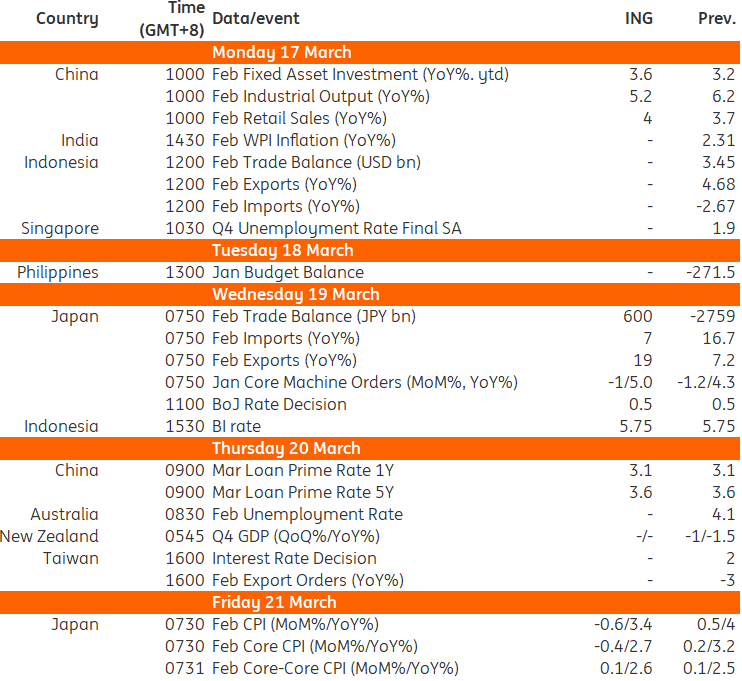

Key events in Asia next week

Source: Refinitiv, ING

More By This Author:

Rates Spark: Issuance Pressure Versus Safety Flight

Eurozone Industrial Production Jumped In January As Hopes For Sustained Revival Grow

Romanian Inflation Remained Elevated In February Amid Energy Price Surge

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more